straight life policy calculator

Depreciation is calculated based on the fiscal years remaining. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

Should I Cancel My Whole Life Insurance Policy White Coat Investor

This is the amount to be paid by life insurance firms.

. Last year depreciation 12 - M. 401 k College Planning Estate Planning Financial Planning. Straight life insurance is a type of permanent life insurance that includes a cash value account that grows over the life of the policy.

The prospective policy buyer should enter the following details. Based on your inputs we recommend a life insurance policy with an approximate value of. Straight life annuities do.

Your total cost for. The straight line calculation as the name suggests is a straight line drop in asset value. A life insurance policys cash value is.

Top 2022 Life Insurance Plans Up to 70 off. Updated last on January 31 2022. Term Life Insurance Quote Tool.

Most of the life insurance premium calculators follow the below steps to calculate the premium of an insurance plan. Fal 3-round burst perk level. If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used.

Straight life policy calculator Thursday March 3 2022 Edit. An online life settlement calculator can provide a quick general assessment of your eligibility to sell your life insurance policy and the potential value of a life settlement. Straight life insurance is a type of permanent life insurance that provides a guaranteed death.

Straight life annuity calculator. Estimate how much coverage you may need to replace your income and get a quote. Offer helpful instructions and related details about Straight Life Annuity Calculator - make it easier for users to find business information than ever.

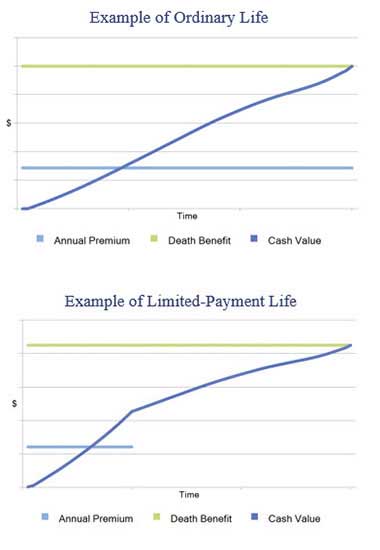

Such as exchanging an annuity. A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy. Years of retirement at.

A 15- or 30-year term life insurance policy could be a good option. Get Your Free Quote in 3 Minutes. Straight life policy calculator Tuesday May 17 2022 Edit A straight life insurance policy offers coverage that lasts a lifetime with premiums.

All life insurance calculators tools. Drivers can lose up. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount.

Find Out Now What Your Life Insurance Policy Could Be Worth With Our Free Calculator. A straight life policy has a level premiumit wont change over the life of your policy. The depreciation of an asset is spread evenly across the life.

Straight life policy calculator Tuesday May 17 2022 Edit A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Limited Pay Life Insurance Everything You Need To Know

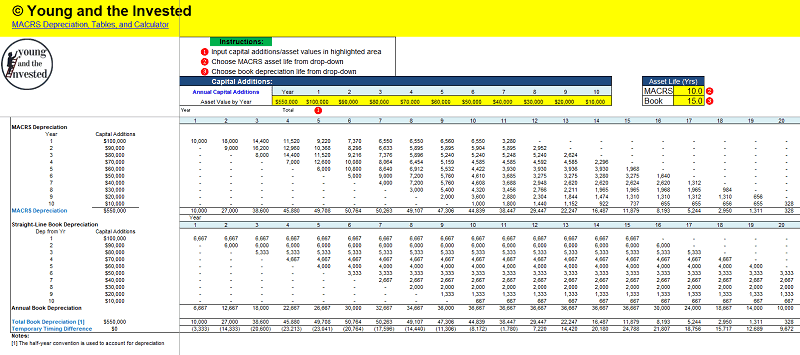

Accumulated Depreciation Formula Calculator With Excel Template

Life Insurance Calculator How Much Do I Need Prudential Financial

Macrs Depreciation Table Calculator The Complete Guide

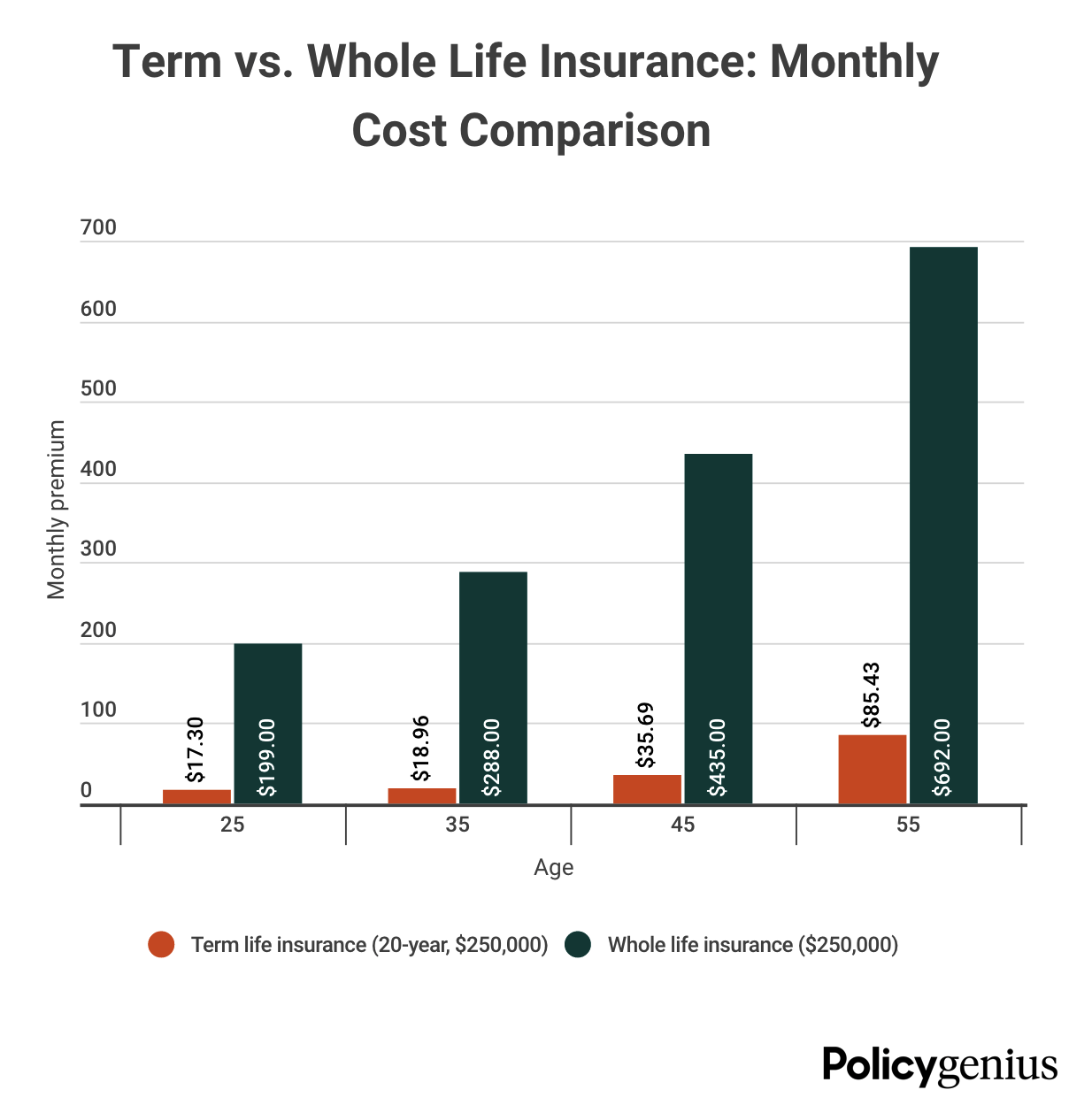

Term Life Vs Whole Life Insurance Policygenius

Whole Life Insurance State Farm

10 Best Tips If You Re Buying Life Insurance For The First Time Forbes Advisor

How To Find A Lost Life Insurance Policy Experian

Life Insurance Calculator How Much Coverage Do You Need

Life Insurance Calculator What Factors To Consider Bestow

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Life Insurance Calculator Term And Whole Life Aflac

Comparing Term Life Vs Whole Life Insurance Forbes Advisor

8 Factors That Affect Life Insurance Premiums

What Are The Benefits Of Whole Life Insurance Northwestern Mutual

How Much Life Insurance Do I Need Nerdwallet

Life Insurance Calculator How Much Do I Need Prudential Financial